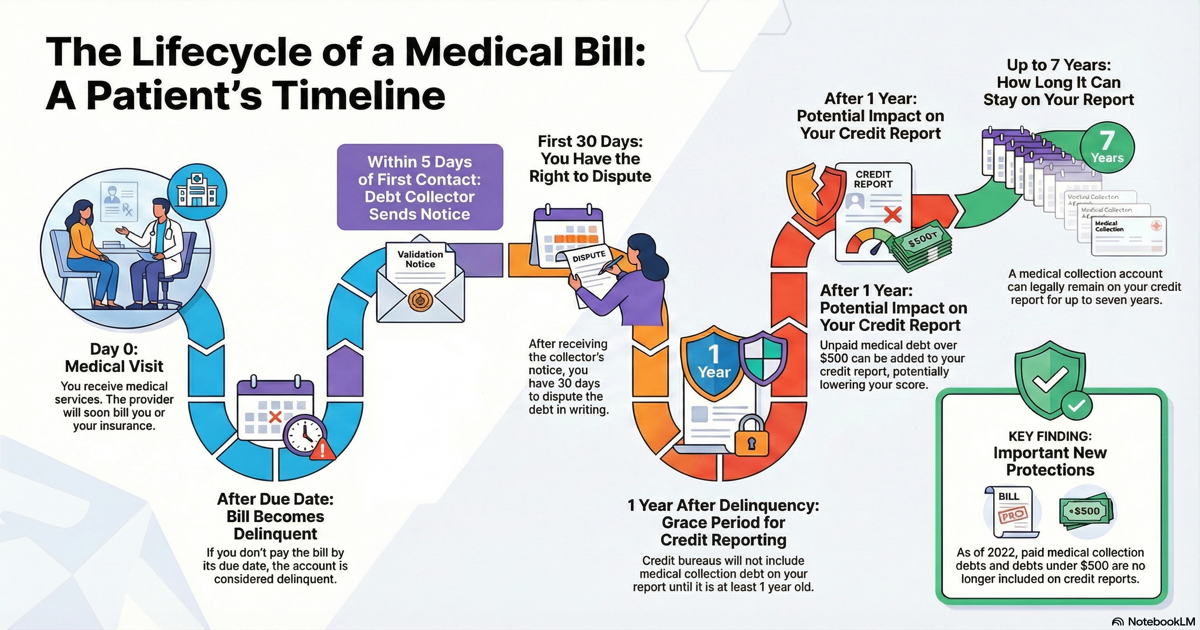

Learn what happens when medical bills go unpaid, from collections to credit reporting. Understand your rights under FDCPA, the 30-day dispute window, and new 2025 protections that prevent medical debt from appearing on credit reports.

What Happens If You Don't Pay a Medical Bill? Timeline & Collections Process

You know that feeling. You go to the doctor or hospital. You get the care you need. You start to feel better. Then, weeks later, a letter arrives in your mail. It's a medical bill. The number at the bottom is big. It's confusing. It's much more than you expected.

You're not alone. Medical debt is a huge problem in America. A recent survey found that four out of ten adults (41%) in the United States have debt from medical or dental care. That's millions of people.

This debt can be scary. What happens if you can't pay? Will it go to collections? What are your rights? This article will give you clear answers. We will walk you through the timeline of what happens when a medical bill goes unpaid. We'll show you when bills go to collections and what your rights are.

Understanding this process is the first step to taking control. When you know what to expect, you can make better decisions. You can protect your rights. You can find the best path forward for you and your family.

Prefer to watch instead? The video below explains what happens when medical bills go unpaid, including the collections timeline, your FDCPA rights, and the 2025 protections that continue to evolve in 2026.

🎥 Watch: What Happens If You Don't Pay a Medical Bill? Complete Timeline Guide from CostKits.

Table of Contents

- Your First Window of Action: Days 0-180

- When Bills Go to Collections: Days 90-180

- Your Rights When a Collector Calls: The 30-Day Window

- How to Check Your Bill Before Collections Starts

- Frequently Asked Questions

- Related Articles

Your First Window of Action: Days 0-180

After you visit a doctor or hospital, the first thing that happens is you get a bill. This bill comes directly from the healthcare provider's office. This is a very important time. It's your first chance to look at the charges and make sure everything is correct.

Many people find these bills confusing. In fact, a survey found that 44% of adults with healthcare debt didn't pay a bill because they weren't sure it was accurate. It's common to see codes you don't understand. You might see charges that don't make sense. This is the best time to call the provider's billing office and ask questions.

Days 0-30: The Initial Bill Arrives

When you first get your medical bill, you have time to review it. Most providers give you 30 days to pay. During this time, you should:

- Look at every line item on the bill

- Check the dates of service

- Make sure you recognize all the charges

- Compare the bill to your insurance Explanation of Benefits (EOB)

If something looks wrong, call the billing office right away. Don't wait. The sooner you catch an error, the easier it is to fix. You can also use our free anonymous medical bill checker to identify errors before contacting the provider.

Days 30-120: Payment Reminders and Grace Period

If you don't pay the bill right away, the provider will start sending reminders. These might be letters in the mail. They might be phone calls. They want to give you a chance to pay what you owe.

This is still a good time to check for errors. Many billing errors can be fixed during this period. You can still talk directly to the provider's billing office. They can help you understand charges. They can fix mistakes.

Most healthcare providers give you a grace period. This is extra time to pay before they take serious action. During this time, they will send more reminders. They might offer payment plans. They want to work with you.

This grace period is important. It gives you time to:

- Check your insurance coverage

- Look for billing errors

- Set up a payment plan if needed

- Apply for financial assistance

Days 90-180: Collections Preparation Begins

If the bill remains unpaid for a while—typically 90 to 180 days in the healthcare industry—the provider might decide to take the next step. They can turn your account over to a professional debt collector. This is when things change.

Important: You still have time to act before collections starts. Use this window to check for errors and dispute any problems you find.

When Bills Go to Collections: Days 90-180

When a provider can't collect the money themselves, they often hire a different company to do it for them. This is called sending a bill to "collections." The healthcare provider might sell your unpaid bill to a third-party company for a fraction of what it's worth. Or they might just hire that company to collect the money on their behalf.

This is a big change for you. Now, instead of dealing with your doctor's office, you'll be dealing with a debt collection agency. There's a special federal law that sets the rules for how these third-party collectors can behave. This law is called the Fair Debt Collection Practices Act, or FDCPA for short.

Why the Hand-Off Matters

The hand-off to collections is important. The FDCPA sets rules for the company your hospital hires to collect the debt. But it doesn't regulate your hospital's own billing department. This is why the hand-off to collections is such a big event. New rules apply. New rights kick in.

Congress created this law because many debt collectors were using harmful and unfair tactics to get people to pay. The government recognized how serious this problem was. They wanted to protect consumers.

The law itself says: "There is abundant evidence of the use of abusive, deceptive, and unfair debt collection practices by many debt collectors. Abusive debt collection practices contribute to the number of personal bankruptcies, to marital instability, to the loss of jobs, and to invasions of individual privacy." (15 U.S. Code § 1692(a))

This law is on your side. It gives you powerful rights.

Your Rights When a Collector Calls: The 30-Day Window

When a debt collector contacts you for the first time, you have important rights under the FDCPA. The law gives you a powerful tool to check if the debt is real and accurate. This all happens within the first 30 days after they contact you. Here's what you need to know.

Rule 1: You Must Be Notified in Writing

A debt collector can't just call you forever without sending you something in writing. The FDCPA says that within five days of their first contact with you, they must send you a written "validation notice" (15 U.S. Code § 1692g). This notice is the official document that explains the debt they are trying to collect.

Rule 2: The Notice Must Contain Key Information

This written notice isn't just a simple bill. By law, it must include very specific information so you can understand what's going on (15 U.S. Code § 1692g(a)). It must tell you:

- The exact amount of the debt

- The name of the creditor you owe the money to (like the hospital or doctor's office)

- A statement telling you that you have 30 days to dispute the debt. If you don't, the collector will assume the debt is correct

- A statement that if you dispute the debt in writing within those 30 days, the collector will get proof of the debt and mail it to you

Rule 3: You Have the Right to Dispute the Debt

This is your most powerful right. If you think there's a mistake, or if you don't recognize the debt, you have 30 days to send a letter to the debt collector saying that you dispute it. If you do this, the collector MUST stop all collection activities until they get proof of the debt (like a copy of the original bill) and mail it to you (15 U.S. Code § 1692g(b)).

Think of this as a legal "pause button." The moment they receive your written dispute, they are legally required to pause all collection efforts until they can provide you with proof. This is a critical step that gives you time to sort out billing errors before they cause more problems.

Why This 30-Day Window Matters

This 30-day window is your golden opportunity. To make the most of it, you need to identify potential errors quickly. A tool like CostKits can analyze your bill in about a minute. It gives you the specific errors you need to include in your dispute letter. This makes your dispute as effective as possible.

What to Do:

- As soon as you get the validation notice, start checking for errors

- Look for duplicate charges, incorrect dates, or services you didn't receive

- Write your dispute letter within 30 days

- Send it by certified mail so you have proof

- Keep copies of everything

How to Check Your Bill Before Collections Starts

You've just read about what happens when medical bills go to collections. The good news is that you can stop this from happening. The best way to prevent collections is to check your bill for errors as soon as you receive it.

Before worrying about collections, verify that your bill matches your EOB — many disputes begin there.

Remember that statistic from the beginning? Nearly half of people with medical debt didn't pay because they suspected the bill was wrong. They were right to be suspicious. Studies show that 80% of medical bills contain at least one error. These errors can cost you hundreds or thousands of dollars. For high-cost services like diagnostic imaging, the stakes are even higher—CT scan prices vary by 1,850% between facilities, making bill verification critical before any payment is made.

The Most Common Medical Billing Errors

Here are the most common types of billing errors:

1. Duplicate Charges Being billed twice for the same service. For example, the same ER visit code appearing twice on the same date.

2. Unbundling Errors When services that should be billed as a package are billed separately. This violates CMS rules.

3. Quantity Errors Being charged for five lab tests when you only had one. This is often a billing system glitch.

4. Gender Mismatch A male-only procedure billed to a female patient, or vice versa. This is usually a data entry error.

5. Preventive Care Misclassification Being charged for an annual wellness visit that should be 100% covered under the Affordable Care Act.

6. No Surprises Act Violations Getting illegal out-of-network charges for an emergency. Federal law protects you from this.

Why Check Bills Early

Checking your bills early gives you the best chance to fix errors. Here's why:

- More time to act: You have 30-120 days before collections starts

- Easier to fix: The provider's billing office can fix mistakes directly

- Better outcomes: Errors caught early are easier to correct

- Less stress: You avoid the collections process entirely

The best way to check for errors is to use a tool designed for this purpose. CostKits is a free tool that helps families manage their medical expenses. It automatically spots overcharges and billing errors. You don't need to be a medical billing expert. The technology does the hard work for you.

How CostKits Works:

- You upload your medical bill (email it or take a picture)

- The system analyzes it for errors in about 60 seconds

- You get a report showing any errors found

- You can generate a dispute letter if errors are found

Don't wait for a billing error to become a financial crisis. Check for overcharges now with CostKits free tier—no credit card required. Take control of your medical bills before they take control of your life.

Updated for 2026: What's Changed About Medical Debt

Last updated: February 9, 2026

The landscape of medical debt protections shifted significantly in 2025–2026. In January 2025, the Consumer Financial Protection Bureau (CFPB) finalized a rule that would have removed approximately $49 billion in medical debt from the credit reports of roughly 15 million Americans. However, in July 2025, a federal court vacated this rule, determining it exceeded the CFPB's statutory authority under the Fair Credit Reporting Act (FCRA).

Despite this federal reversal, state-level action continues to expand consumer protections. As of early 2026, 15 states have enacted laws restricting medical debt reporting to credit bureaus, with nine of these laws taking effect in 2026 or on January 1, 2026. If you live in one of these states—including Oregon, Maryland, and others—your unpaid medical debt cannot appear on your credit report, even if it exceeds $500. Meanwhile, the three major credit bureaus continue to voluntarily exclude paid medical debts and unpaid debts under $500 from credit reports, though this is a voluntary practice subject to change.

Stay informed: Review the CFPB's latest guidance on medical information and credit reporting and check the National Consumer Law Center's updated resources on state medical debt protections to see if your state offers protection.

Frequently Asked Questions

How long before a medical bill goes to collections?

Most healthcare providers send bills to collections after 90 to 180 days of non-payment. However, this timeline can vary by provider. Some may send bills to collections sooner, while others may wait longer. The important thing is to check your bill for errors as soon as you receive it, before it goes to collections.

What happens when a medical bill goes to collections?

When a medical bill goes to collections, a third-party debt collector takes over. They must follow the Fair Debt Collection Practices Act (FDCPA). Within 5 days of first contact, they must send you a written validation notice. You have 30 days to dispute the debt in writing. If you dispute it, they must stop collection activities until they provide proof of the debt.

What are my rights when a debt collector calls?

You have important rights under the FDCPA. Within 5 days of first contact, the collector must send you a written validation notice. You have 30 days to dispute the debt in writing. If you dispute it, they must stop all collection activities until they provide proof. They cannot harass you, call you at unreasonable times, or use abusive language.

What should I do if I get a validation notice from a debt collector?

As soon as you get the validation notice, start checking for errors. Look for duplicate charges, incorrect dates, or services you didn't receive. Write your dispute letter within 30 days. Send it by certified mail so you have proof. Keep copies of everything.

Can I still dispute a bill after it goes to collections?

Yes. Even after a bill goes to collections, you can still dispute it. You have 30 days from when you receive the validation notice to dispute the debt in writing. If you dispute it, the collector must stop all collection activities until they provide proof of the debt.

How can I check my medical bill for errors before it goes to collections?

You can check your medical bill for errors by reviewing each line item, comparing it to your insurance EOB, and looking for common mistakes like duplicate charges or incorrect dates. Tools like CostKits can automatically analyze your bill for errors in about 60 seconds, checking for all 6 common error types.

About the Author

John Caruso, FSA, MAAA is a healthcare actuary with 20+ years of experience in insurance pricing, medical billing systems, and healthcare cost analytics. He founded CostKits to help families understand and control their healthcare expenses. Connect on LinkedIn →

Related Articles

- Medical Debt and Credit Reports: New 2025 Rules & Protection - Learn how medical debt affects your credit and what new protections mean for you

- How to Stop Medical Bill Problems Before They Start - Learn how to check your bills for errors before they go to collections

- How to Fight Medical Bill Errors: The Complete Dispute Toolkit - Get dispute templates and step-by-step guidance

- How to Read Your Medical Bill: A Step-by-Step Guide for Families - Understand every line on your bill

- EOB vs Medical Bill: Complete Guide - Compare these critical documents

- How to Negotiate Your Medical Bills: A Patient's Playbook - Master negotiation tactics to reduce what you owe

- How to Read Your EOB Line by Line - Understand your Explanation of Benefits

- The System Wasn't Built For You But CostKits Is - Learn how to navigate healthcare complexity

Take Control of Your Medical Bills with CostKits

The American medical billing system is confusing. The consequences of unpaid bills can be truly frightening. But you have rights. You have tools. You have the power to take control.

The most important thing you can do is be proactive. Don't just ignore a medical bill and hope it goes away. Take a close look at it. Ask questions. Use the tools and rights you have to make sure you only pay for the care you actually received, and not a penny more.

CostKits can help you check your medical bills for errors—for free. Our free tier lets you analyze unlimited medical bills with no credit card required. Simply upload your bill, and our AI will automatically check for the 6 most common types of billing errors:

- Duplicate charges

- Unbundling errors

- Quantity errors

- Gender mismatches

- Preventive care misclassification

- No Surprises Act violations

The analysis takes about 60 seconds. If errors are found, you'll see exactly what's wrong and how much you might save. You can then generate a dispute letter to send to your provider or insurance company.

Sign up free → https://app.costkits.com/signin/ (magic link; no card required)

Take action now. Check your bills before they go to collections. Protect your financial future. Protect your peace of mind. The system wasn't built for you—but CostKits is.